When concentrates are purchased for direct consumption, they are named for the different consistencies created by the extraction. These waxes, oils and shatters are formulated for use in portable vaporizers and elaborate vaporizing rigs.

Some extract concentrates have tested as high as 80 percent in THC, the psychoactive compound found in cannabis. That is significantly higher than the THC content found in flower form of the strongest strains, which typically tests in the mid to high 20s.

On Oct. 17, 2019, edibles, topicals and extracts became legal in Canada. For the December 2021, 16,636,345 packaged units of cannabis have been sold across Canada for medical and non-medical purposes. Edible cannabis sales represented 24% of total sales and, with 3,999,801 packaged units sold and cannabis extracts sales represented 17% of total sales, with 2,874,370 packaged units sold, totaling 41%.

Recent data showed that the sales of cannabis extracts and edibles grew 80% and 125% correspondingly in 2021. That compares to 30% increase in growth of dried cannabis during the same period.

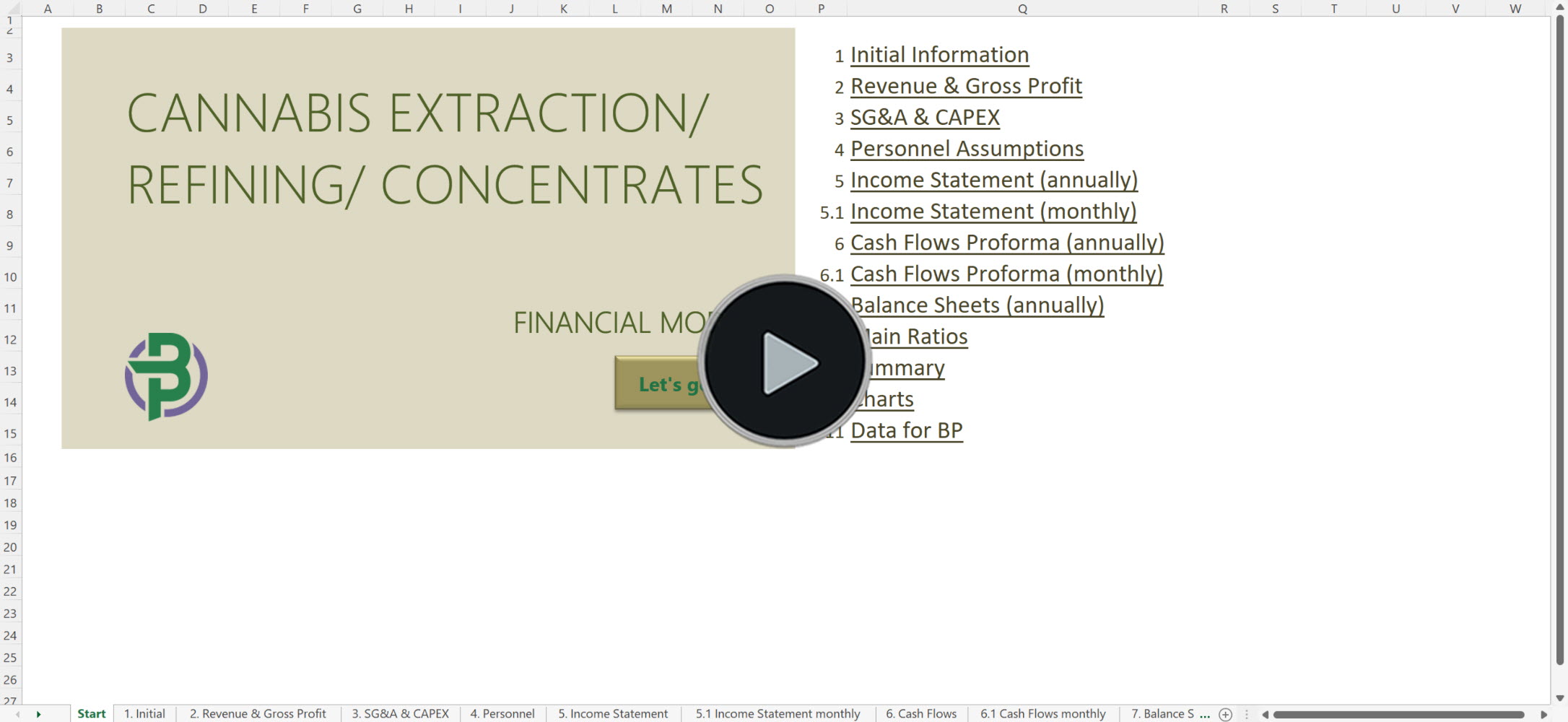

How Much Does it Cost to Start a Cannabis Extraction Business

$1 million scenario:

- $150,000 legal and professional fees, insurance

- $50,000 building renting (including security deposit)

- $60,000 marketing campaign

- $50,000 space improvements including finishing/painting, kitchen, office space, bathrooms, etc.

- $300,000 extraction equipment

- $125,000 post-processing lab/refining equipment

- $35,000 security system

- $5,000 computer system

- plus direct costs, including material

- plus salaries, direct and managerial

- plus operational and administrative costs

= approximately $1,000,000 start-up expenses

Revenue = $5,085,600 (100%)

-Direct Costs = $2,640,051 (52%)

Gross Profit = $2,445,549 (48%)

– Operating Expenses = $678,572 (13%)

Operating Income = $1,766,977 (35%)

'70% ready to go' business plan templates

Our cannabis extraction financial models and cannabis extraction business plan templates will help you estimate how much does it cost to start and operate your own cannabis extraction business, to build all revenue and cost line-items monthly over a flexible seven year period, and then sums the monthly results into quarters and years for an easy view into the various time periods.

Should you have any questions, please do not hesitate to contact us.

Cannabis Extraction Financial Model Sample

Cannabis Extraction Business Plan Sample

Cannabis Extraction Pitch Deck Sample

CBD Oil Extraction Lab Business Plan Templates can be found at hempcbdbusinessplans.com.